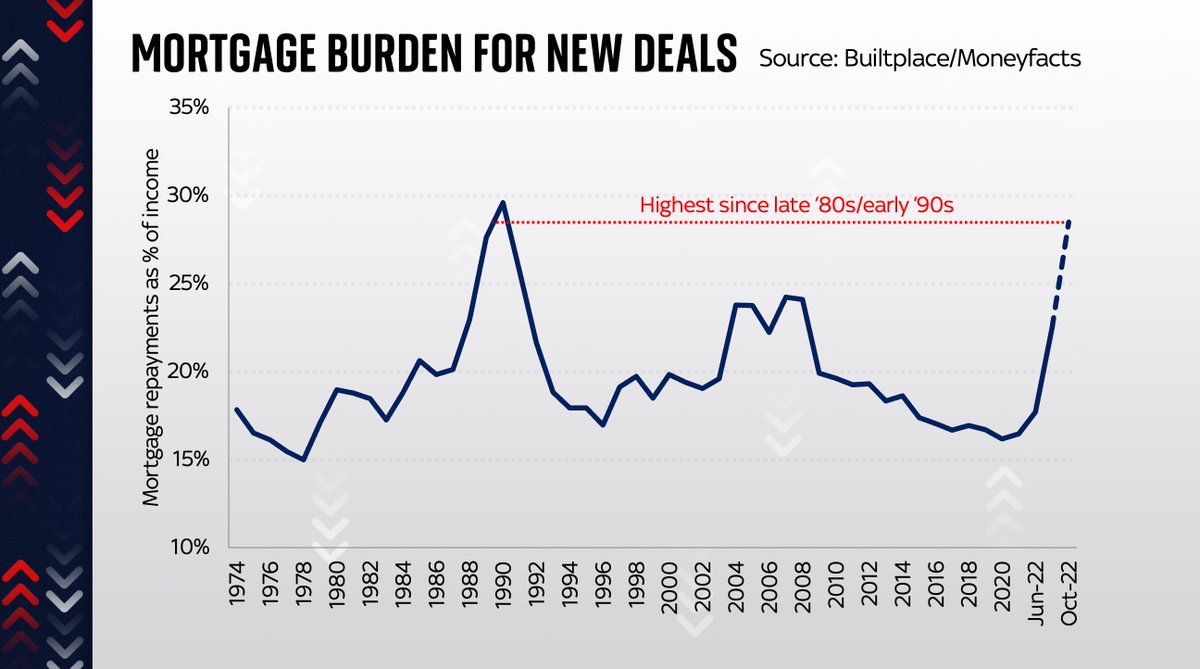

30+ percent of income on mortgage

However as mortgage rates continue to. Most home loans require a down payment of at least 3.

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Ad Compare the Best House Loans for February 2023.

. Lock Your Rate Today. The Trusted Lender of 300000 Veterans and Military Families. Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Web 2 days ago30-year fixed mortgage rates. Web Pretty sure the 30 rule comes from US housing regulations in the 60s which capped public housing rent at 25 of the tenants income and then it subsequently went to 30.

Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Get Instantly Matched With Your Ideal Mortgage Lender.

Were not including any expenses in estimating the income. However many lenders let borrowers exceed 30. Principal interest taxes and insurance.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Keep your total monthly debts including your mortgage.

Web If youd put 10 down on a 333333 home your mortgage would be about 300000. Apply Get Pre-Approved Today. Keep your mortgage payment at 28 of your gross monthly income or lower.

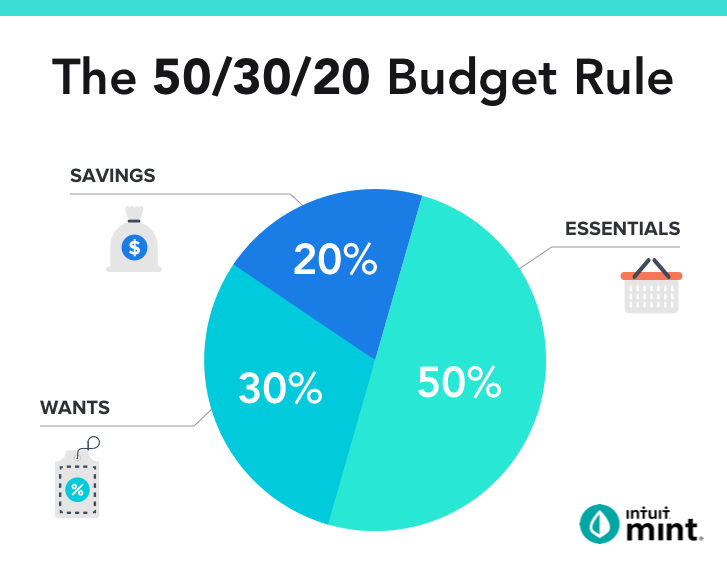

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web For example personal finance experts recommend spending no more than 30 percent of total income on housing.

Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance. Web The Bottom Line. Lets say your total.

Web Typically lenders cap the mortgage at 28 percent of your monthly income. A 20 down payment is ideal to lower your monthly. Web Traditionally the industry says to spend no more than 30 of your gross income on your monthly mortgage payment.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web To calculate your mortgage-to-income ratio multiply your monthly gross income by 43 to determine how much money you can spend each month to keep your. As a general rule you want to spend no more than 30 percent of your monthly gross income.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. The 3545 Rule The 3545. That leaves 20 percent of your paycheck to.

The Trusted Lender of 300000 Veterans and Military Families. 20-year fixed mortgage rates. 5375 down from 7625 -2250.

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for. In that case NerdWallet recommends an annual pretax income of at least 110820. Debt-to-income ratio DTI is a percentage that compares.

Web Just how much of your income should be going towards your home. Web The amount of money you spend upfront to purchase a home.

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Your Income To Spend On A Mortgage

Your Mortgage Should Not Exceed 2 5x Gross Income By Pendora The Startup Medium

Understanding Real Estate Data Investment Property Analytics Suburbsfinder

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

50 30 20 Budgeting Rule Calculator Detailed Explanation Intuit Mint

Claus Hesseling On Twitter Edconwaysky If You Should Pay 30 Percent Of Your Income For A Mortgage Add Energy Costs Which Companies Will Even Continue To Offer Mortgages Twitter

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

U S Cities With The Highest Rates Of Mortgage Delinquency

What Percentage Of Income Should Go To Mortgage Morty

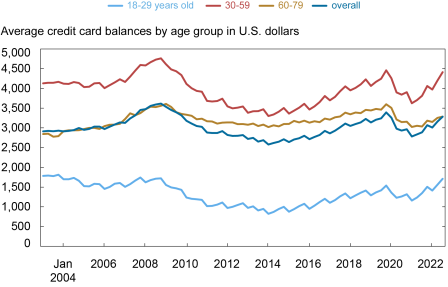

Balances Are On The Rise So Who Is Taking On More Credit Card Debt Liberty Street Economics

What Percentage Of Your Income Should Go To Your Mortgage Hometap

3 Mortgage Delinquency Rates Left Scale And House Price Appreciation Download Scientific Diagram

Your Guide To The 50 30 20 Budgeting Rule Forbes Advisor

Mortgage Lender Woes Wolf Street

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

San Francisco Bay Area Housing Affordability Home Team Paragon Real Estate